Week 5: Understanding the money and the logic that VCs use

This week gets into the weeds of how a VC fund works and why growth matters so much early on. The lunch guest is Jim Murphy of Elora Brewery (and PostRank, Boltmade, Shopify, etc).

With much of the fundraising advice out there authored or influenced by venture capitalists, some details of how things work are often glossed over. The focus of most information tends to be on ‘how can you qualify’ for fundraising or ‘what did X do?’ instead of ‘why would you do this?’ or ‘how does this work?’

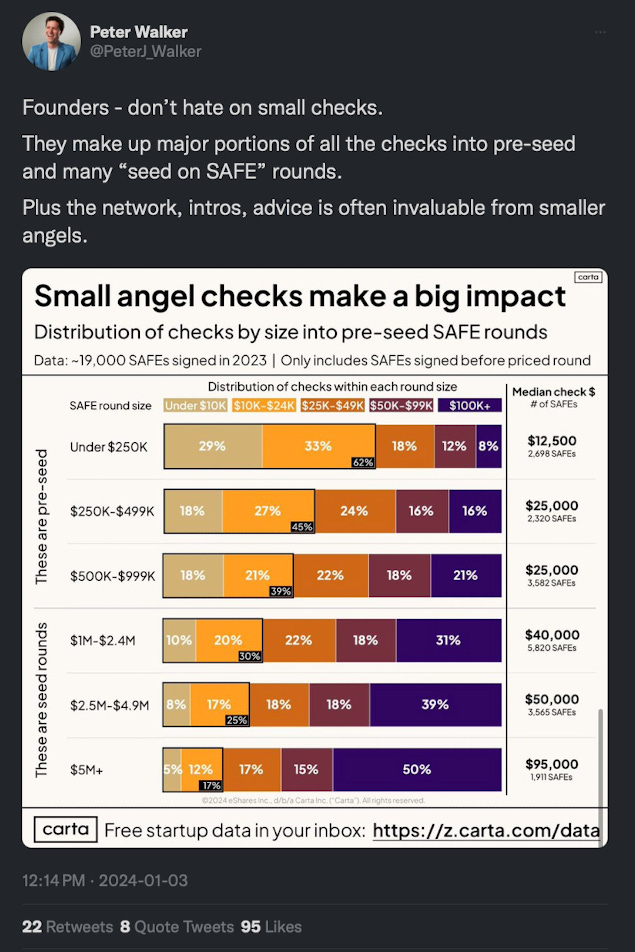

Understanding some of the motivations behind the industry that funds startups will hopefully help you make better decisions for your company. This helps. You can hopefully start to understand what is behind things like the data here and the difference in motivation of early investors vs one at an institution.

This week we dig into details around:

A venture fund timeline.

How do venture funds get a return to their investors?

Why a valuation has little to do with the actual value of a company.

The following week we will talk about how you can align yourself with this information and use it to your advantage.

Lunch guest: Jim Murphy of Boltmade (sold to Shopify) and Elora Brewery

Jim has a long history with startups and software development that spans both Boston and Waterloo. Locally he led engineering at PostRank (they sold to Google), built Boltmade (a product/dev shop that sold to Shopify), and led Engineering at Shopify for a bit. He now focuses on the brewery he started ~10 years ago (Elora Brewery), helping founders, and his farm.

Please RSVP for lunch today (Monday)!

…and a reminder, to keep building and talk to people that will use your product.